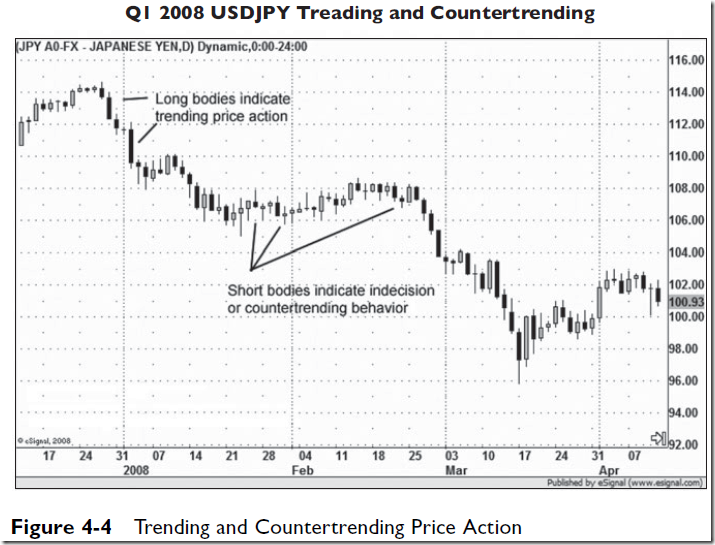

TRADING DAYS VERSUS TRENDING DAYS

Trading days are when there are no fundamental announcements. Currency

charts move typically 60 to 90 pips, and sometimes 120 pips, depending on

the currency. Trending days are fundamental announcement days, when the

market will generally take off in a direction after the announcement and

move 120 to 240 pips within the first five hours, incurring a major price

change. It then often stays at that new price for the remainder of the day.

Novice traders prefer trading days as the market is typically more

predictable. Expert traders, however, prefer trending days over trading days

because you can make more money in less time.

At 7 p.m. EST, the Asian markets open (8 a.m. local Asian time) and

continue for approximately 8 hours.

At 3 a.m. EST, the European markets open (8 a.m. local British time)

and continue for approximately 8 hours.

At 8 a.m. EST, the American markets open and continue for 8 hours.

The following are fundamentals announced in the United States:

Purchasing Managers Index (Chicago PMI): This announcement is

based on surveys of more than 200 purchasing managers in the manufacturing

industry who are based in the Chicago area. This distribution of

manufacturing firms mirrors the national distribution in the United States.

Readings above 50 percent indicate an expanding factory sector, whereas

values below 50 percent are indicative of contraction. This announcement

is made on the last business day of every month at 10 a.m. EST.

Consumer Confidence Index (CCI): This is a survey of 5,000

consumers monitoring their attitudes toward the current situation and

expectations regarding economic conditions. This report can occasionally

be helpful in predicting sudden shifts in the economy. It can also give a

trader an idea about the direction of the U.S. economy. Only index changes

of at least five points should be considered significant. The announcement

is made on the last Tuesday of every month at 10 a.m. EST.

Consumer Price Index (CPI): CPI measures the change in price of a

representative basket of goods and services, such as food, energy, housing,

clothing, transportation, medical care, entertainment, and education. It is

also known as the cost-of-living index. It is important because it excludes

food and energy prices for it’s monthly stability, referred to as the core CPI,

and gives a clearer picture of the underlying inflation trend. This announcement

is made around the 13th of every month at 8:30 a.m. EST.

Durable Goods Orders: The official name of this announcement is the

“Advance Report on Durable Goods Manufacturers, Shipments and Orders.”

It is a government index that reflects the dollar volume of orders, shipments,

and unfilled orders of durable goods. Durable goods are new or used items

with a normal life expectancy of three years or more. This generally excludes

defense and transportation orders because of their volatility. This report gives

the trader information on the strength of demand for U.S. manufactured

durable goods—from both domestic and foreign sources. An increase in the

index suggests that demand is strengthening, which may result in rising production

and employment. A falling index obviously indicates the opposite.

The data is released around the 26th of every month at 8:30 a.m. EST.

Employment Situation: This report lists the number of payroll jobs at

all non-farm business establishments and government agencies. The unemployment

rate, average hourly and weekly earnings, and the length of the

average workweek are all listed in this report. This release is the single

most closely watched economic statistic because of its timelines, accuracy,

and its importance as an indicator of economic activity. It plays a big role

in influencing financial market psychology during the month.

Non-farm Payroll Indicator: This fundamental is a co-incident indicator

of economic growth. The greater the increase in employment figures,

the faster the total economy will grow. An increasing unemployment rate is

associated with a contracting economy and declining interest rates. A

decreasing unemployment rate is associated with an expanding economy

and potentially increasing interest rates. The fear is that wages will rise if

the unemployment rate becomes too low and workers are hard to find. The

economy is considered to be at full employment when unemployment is

between 5.5 and 6 percent. The data is released on the first Friday of every

month at 8:30 a.m. EST.

Existing Home Sales: This report measures the selling rate of preowned

houses and is considered a decent indicator of activity in the housing sector.

It provides a gauge of not only the demand for housing but also the economic

momentum. People have to be financially confident in order to buy a house.

The data is announced on the 25th of every month at 10 a.m. EST.

Gross Domestic Product (GDP): GDP measures the dollar value of

goods and services produced within the borders of the United States,

regardless of who owns the assets or the nationality of the labor used in

producing that output. This is the most comprehensive measure of the

performance of the U.S. economy. Healthy GDP growth is between 2.0 and

2.5 percent (when the unemployment rate is between 5.5 and 6 percent). A

higher GDP growth leads to accelerating inflation, and lower growth indicates

a weak economy. This data is released in the third or fourth week of

every month at 8:30 a.m. EST.

New Home Sales: This report is based on interviews with approximately

10,000 builders, or owners of about 15,000 selected building

projects. It measures the number of newly constructed homes with a committed

sale during the month. It is considered an indication of near-term

spending for housing-related items and of consumer spending in general.

However, investors prefer the existing home sales report, which accounts

for around 84 percent of all houses sold earlier in the month.

Philadelphia Fed: This is a regional manufacturing index that covers

Pennsylvania, New Jersey, and Delaware, which represents a reasonable

cross section of national manufacturing activities. Readings above 50 percent

indicate an expanding factory sector, whereas values below 50 percent

indicate contraction. The data is released on the third Thursday of every

month at 10 a.m. EST.

Producer Price Index (PPI): The PPI measures the average price of a

fixed basket of capital and consumer goods at the wholesale level, which

gives a clearer indication of the underlying inflation trend. There are three

primary publication structures for the PPI: industry, commodity, and stageof-

processing. It’s important to monitor the PPI excluding food and energy

prices for its monthly stability. This announcement is made around the 11th

of every month at 8:30 a.m. EST.

Retail Sales: This index measures the total sales of goods by all retail

establishments in the United States (sales of services are not included).

These figures are in current dollars, which means they are not adjusted for

inflation; however, the data is adjusted for seasonal, holiday, and

trading-day differences between months of the year. The retail sales index

is considered the timeliest indicator of broad consumer spending patterns,

providing a sense of the trends among different types of retailers. These

trends can help you spot specific investment opportunities. The data is

released around the 12th of every month at 8:30 a.m. EST.

International Trade: This report measures the difference between

exports and imports of U.S. goods and services. Imports and exports are

important components of aggregate economic activity—representing

approximately 14 percent and 12 percent of the GDP, respectively. Typically,

stronger exports are bullish for the dollar. The data is announced on

the 19th of every month at 8:30 a.m. EST.

The above economic indicators are the most relevant for the six major

world currencies on the Forex market, but that does not mean they are the

only ones. Once again, you can keep up with all major government reports

that affect the Forex at www.markettraders.com or www.forextips.com,

under the heading “Economic Reports”. I strongly suggest you review the

economic calendar daily before you trade in order to be prepared for any

surprise movements in the market.