Wednesday, October 31, 2012

Tuesday, October 30, 2012

NYSE Arca Disk Drive Index ($DDX)

The NYSE Arca Disk Drive Index (DDX) is an equal-dollar weighted index designed to measure the performance of a cross section of companies active in designing and manufacturing electronic data storage devices for computers, as well as software that helps computers interface with those devices. The DDX Index was established with a benchmark value of 200.00 on November 15, 1996. The DDX Index is rebalanced quarterly based on closing prices on the third Friday in February, May, August & November to ensure that each component stock continues to represent approximately equal weight in the index.

There’s no good and tradable ETP at the moment. SSDD (ETN) is very thin.

Morgan Stanley Cyclical Index

Morgan Stanley Cyclical Index

The Morgan Stanley Cyclical Index (CYC) is an equal-dollar weighted index designed to measure the performance of economically sensitive industries within the U.S. economy and detect shifts in investor sentiment. The CYC Index comprises 30 stocks from over 25 industries, including automobiles, metals, papers, machinery, chemicals and transportation. The CYC Index was established with a benchmark value of 200.00 on December 31, 1991. To ensure that each component stock continues to represent approximately equal weight in the Index, adjustments are made annually, based on closing prices on the third Friday in December.

唐炜臻被判诈骗罪名成立 萧红黯然泪下(图)

http://www.naol.ca/news/na/2012/10/30-6.htm

北美在线(NAOL.CA): 陪审团裁决唐炜臻诈骗罪名成立,唐炜臻表示会上诉。

加国无忧萧山报道,多伦多金融投资顾问唐炜臻被控刑事诈骗罪一案﹐控﹑辩双方昨日向陪审团作出结案陈词。主审法官奥玛拉(Alfred O'Marra)今天上午对12名陪审团成员提供判决指示后﹐陪审团经过几个小时的闭门讨论,于下午3点左右做出裁决,裁定唐炜臻一项诈骗投资者超过2000万元的罪名成立。

唐炜臻听到陪审团裁决结果之后,向媒体表示会上诉。并表示陪审团是受到法官和检控官的误导,才做出对他不利的裁决,在加拿大的司法历史上,还没有人挑战政府,可能陪审团也是看他跟政府机构-证监会对抗,本能的认为他有罪。

至于上诉能否翻案,一向信心满满的唐炜臻也显得有些底气不足,“结果看来不乐观,目前也没有钱请辩护律师,翻案有困难。”

陪审团裁决唐炜臻诈骗罪名成立,唐炜臻表示会上诉

唐炜臻一家3口今天都来到法庭,为他打气表示支持,太太萧虹面对媒体谈到从2009年证监会禁止唐炜臻为客户交易并就庞氏诈骗进行刑事调查以来,他们一家一直面对巨大的压力,除了生活方面的经济压力,儿子也被读书的中学劝退,今年已经18岁上大学遥遥无期,谈到这些生活困境,萧红黯然落泪。

虽然到了判罪的关键时刻,唐炜臻的情绪一如既往的高昂,他坚称自己无罪,所以根本不会担心陪审团判自己诈骗罪名成立。

唐炜臻坚称自己无罪

陪审团宣布裁决之前,唐炜臻还乐观的认为结果一定会对自己有利,“他们(指陪审团成员)每人都有一本我写的书,英文的,对我相当了解,应该不会认为我有罪。”

唐炜臻认为这次自己在没有辩护律师的情况下,坚持了50多天的审讯,比最初想象的好很多。开始时比较迷茫,后来随着案情的进展,加上法律之友的帮助,越来越清楚了,自己也越来越有信心。政府是有财力、人力和物力,如果个人有财力请律师,当然情况会完全不同,但是政府中止了自己的交易,等于切断了经济来源,对他来说非常不公平。

一家三口步入法庭

有记者问他,如果被判有罪,他们一家人有没有做好准备?唐炜臻坚称自己没罪,判他有罪是检控官和法官误导陪审团,所有的东西都是纸上谈兵,他们没有任何实质证据,我既没有海外资产,也没有买任何东西,我甚至把自己的钱都给了投资者。

屋漏偏逢连夜雨,唐炜臻的案件审讯还没有结束,又接到银行的通知,要为他现在居住的房屋做检查,唐伟臻称这种检查是为拍卖做准备,一旦房子没有问题,很可能会尽快拍卖,“到时我就要住到大街上了。”唐炜臻无奈的说。

唐炜臻将面对最高14年的判刑,有刑事律师认为唐炜臻应该获判判多于4年的刑期。

唐炜臻案的审讯从今年9月10日开始,期间法庭传召了多名证人,包括他的投资者和安省证监会的有关职员。

萧红谈到过去几年面对的生活困境,黯然泪下。

银行要求验楼的通知

Thursday, October 25, 2012

IB Pages Maintenance: Sector, Geo

c:\jts\export_geo.csv

c:\jts\export_sector.csv

Use Import/Export Contract feature.

Need a earning season calendar to remind important dates

I missed GOOG’s and FB’s, almost missed PG’s. Unaware of AAPL’s is today after close. I need a tool to remind myself.

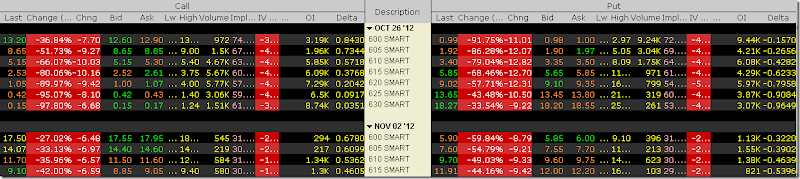

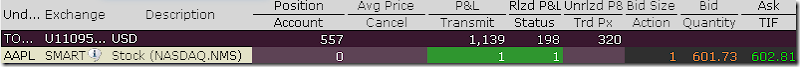

At Oct 25 market closed, Oct 26, 615 straddle is $31.75. Nov 2, 615 straddle is $36.58.

At Oct 26 market opened, Oct 26, 615 straddle is $8.38. Nov 2, 615 straddle is $21.01. Volatility collapsed!

I made $1 in after hour trade.

Wednesday, October 24, 2012

Year End Radar Reference Table Maintenance – Identify Trading Holidays

http://www.rightline.net/calendar/market-holidays.html, find the trading holidays

All Markets, All Years (to 2022)

http://markets.on.nytimes.com/research/markets/holidays/holidays.asp?display=market&exchange=NYQ

Special Stock Market Holiday Rules

There are a few special rules that apply to stock market holidays:

- Although the day after Thanksgiving (Friday) is not an official holiday, the market has a tradition of closing at 1:00 p.m. ET.

- When any stock market holiday falls on a Saturday, the market will be closed on the previous day (Friday) unless the Friday is the end of a monthly or yearly accounting period.

- When any stock market holiday falls on a Sunday, the market will be closed the next day (Monday).

Some market holidays are observed on different dates each year:

- Martin Luther King, Jr. Day is always observed on the third Monday in January.

- President's Day is always observed on the third Monday in February.

- Memorial Day is always observed on the last Monday in May

Friday, October 12, 2012

Wednesday, October 10, 2012

<<the misbehavior of markets>> by Mandelbrot and Hudson

5 rules of market behaviors:

1) Market are risky; 2) Trouble runs in streaks; 3) Markets have a personality; 4) Markets mislead. Patterns are the fool’s gold of financial markets. The power of chance suffices to create spurious patterns and pseudo-cycles that, for all the world, appear predictable and bankable. They would fool any professional “chartist.” Likewise, bubbles and crashes are inherent to markets. They are the inevitable consequence of the human need to find patterns in the patternless. 5) Market time is relative. “Trading time” is quite distinct from the linear “clock time”. This trading time speeds up the clock in periods of high volatility, and slows it down in periods of stability.

10 Heresies of Finance

- Markets are turbulent.

- Markets are very, very risky – more risky than the standard theories imagine. It’s hard to predict, harder to protect against, hardest of all to engineer and profit from. The Wall Street mantra is asset allocation. It’s far more important than the specific stocks or bonds you pick. 25% cash, 30% bonds, and 45% stocks.

- Market “timing” matters greatly. Big gains and losses concentrate into small packages of time. From 1986 to 2003, USD descent against JPY. Nearly half that decline occurred on just 10 out of those 4695 trading days. 46% of the damage to USD investors happened on 0.21% of the days. In the 1980’s SP500, 40% of positive returns came during 10 days – about 0.5% of the time.

- Prices often leap, not glide. That adds to the risk. The result is a far-wilder distribution of price changes: not just price movements, but price dislocations.

- In markets, time is flexible.

- Markets in all places and ages work alike.

- Markets are inherently uncertain, and bubbles are inevitable. Parable: Land of Ten Thousand Lakes. Explorers = investors, fogs = the limits of our knowledge, lakes = prices of 10,000 different securities.

- Markets are deceptive. Chance alone can produce deceptive convincing patterns.

- Forecasting prices may be perilous, but you can estimate the odds of future volatility. Random Walk model’s first claim is the so-called martingale condition: your best guess of tomorrow’s price is today’s price. It helps in an intuitive way to explain why we so often guess the market wrong. Markets can exhibit dependence without correlation. The key to this paradox lies in the distinction between the size and the direction of price changes. A 10% fall yesterday may well increase the odds of another 10% move today – but provide no advance way of telling whether it will be up or down. Large price changes tend to be followed by more large changes, positive or negative. Small changes tend to be followed by more small changes. Volatility clusters.

- In financial markets, the idea of “value” has limited value. How, you ask, does one survive in such an existentialist world, a world without absolutes? People do it rather well all the time. The prime mover in a financial market is not value or price, but price differences; not averaging, but arbitraging. People arbitrage between places and times. Between places: driving used convertible to California to sell dear. Between times: Scalping.

Olsen “We literally know nothing about how economics works.”

OANDA Services

OANDA.com—Currency information, tools, and resources for investors, businesses, and travelers.

fxTrade—A fair, transparent, low-cost and flexible forex trading platform for traders, investment managers, financial institutions, and corporations. With a free unlimited-use practice platform, APIs for automated trading, and fxTrade Client Manager, a trading interface for multi-client trade execution and reporting.

fxGlobalTransfer—A convenient, secure and completely online foreign currency transfer service. Clients can take advantage of the same exchange rates that professional traders receive on major currencies.

Forex Blog—RSS feeds and daily market reports from our resident currency analysts.