Friday, November 30, 2012

Thursday, November 29, 2012

Wednesday, November 28, 2012

Tuesday, November 27, 2012

masterthegap.com

http://www.masterthegap.com

Gap Zone Map

Location. Location. Location.

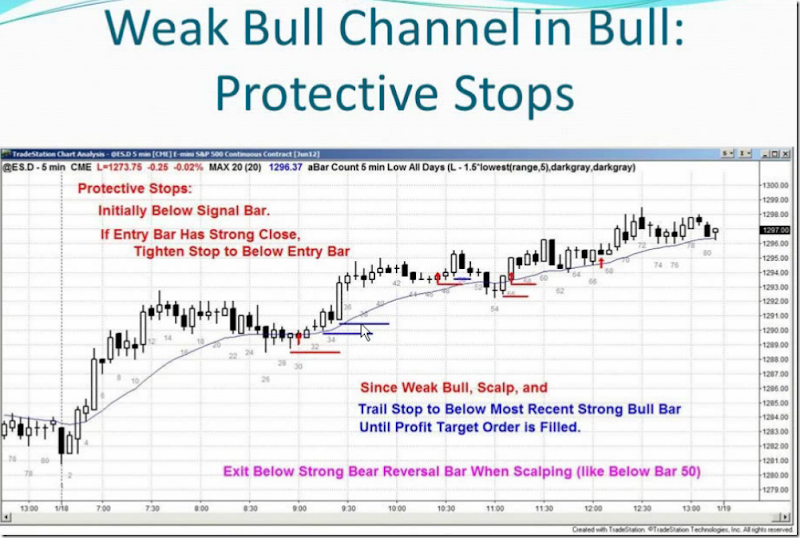

Where the gap opens relative to the prior day's price action is the key to our gap research. We use "zones" to segment and organize historical gaps into groups that may exhibit similar trading patterns. We have tested many types of support and resistance including pivots, Fibonacci's, and moving averages and found that the prior day Open, High, Low, Close (OHLC) and price direction from open to close (up or down), work well for grouping purposes.

Gap ZonesSM work well for analyzing gap setups because they inherently incorporate:

- Nearby support and resistance

- Short term trend

- Gap size

- Trader psychology

This following map shows the 10 potential areas in which a gap may open on a given day.

![]()

Note: the historical win rate in the S&P 500 E-mini futures for each zone is shown and assumes you faded the gap at the open and held for gap fill (prior day close i.e. thick, yellow line) or until the end of the day if gap did not fill.

Nomenclature:

D = prior day was "down" (directionally from open to close)

U = prior day was "up"

H = above the prior day's high price

HO = below the prior high and above the prior day's open

OC = below the prior open and above the prior close

CL = below the prior close and above the prior low

HC = below the prior high and above the prior close

CO = below the prior close and above the prior open

OL = below the prior open and above the prior low

L = below the prior day's low price

© 2008-2010 masterthegap.com. All Rights Reserved. Reproduction without permission prohibited.

Saturday, November 24, 2012

Some cautions about Triangles

Thursday, November 22, 2012

Wednesday, November 21, 2012

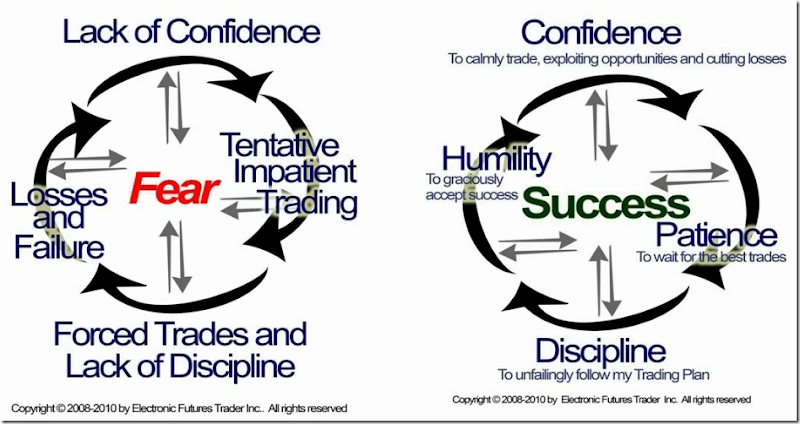

Webinar: Overcoming Fear in Trading

http://www.bigmiketrading.com/webinars/nov5_2012/jeff_quinto_overcoming_fear_in_trading/

Need to have a written trading plan.